|

•SHARIAH based company along with the ISO certified and having sound financial health for Claim Paying ability evidenced by Credit rating as A+ • Dedicated account manager with round the clock coverage • Can tailor the coverage scheme as per your requirements • Significantly low costs • Cost sharing with the employer. |

||||||

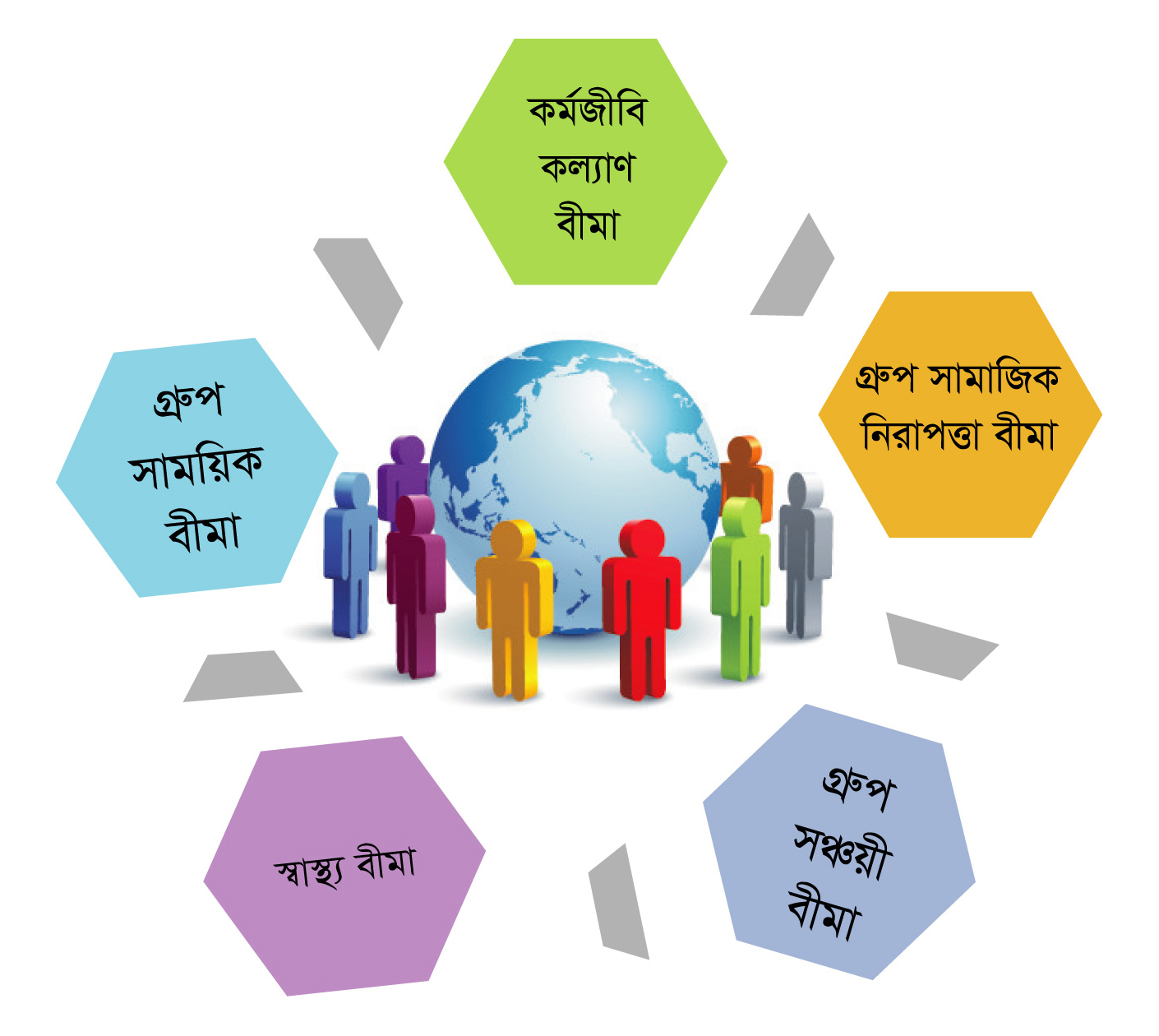

| Group Insurance Products | |||||||

| Group insurance is a cost effective way of providing protection against the financial losses caused by death, disability or retirement to a group of individuals who are associated with the policyholder by some common relationship other than insurance. Prime Islami Life offers group insurance schemes to various groups as follows: | |||||||

|

• Semi-Government organization, autonomous bodies • Private, Non-Government Organizations (NGO's) • Educational & Financial Institutions • Public Limited Companies • Associations, Business organizations etc. • Garments and Other Industries • Foreign Mission, Airlines |

|||||||

| The main feature of the schemes are low premium, simple insurable conditions such as employee not being absent from duty on grounds of ill health on the day of entry, and easy administration by way of issue of a single master policy covering all the employees/members. Group insurance is usually a service benefit provided by the employer to its employees. | |||||||

| Choice of Scheme | |||||||

|

• Group Term Life Insurance Scheme • Group Term Premium Refund Insurance Scheme • Group Endowment Insurance Scheme • Exclusive Scheme for open the window of any other financial Products |

|||||||

| We offer several Supplementary covers, which you can include with your basic insurance coverage to get even more return. These Supplementary products are as follows: | |||||||

|

• Accidental Death Benefit (ADB) • Permanent & Total Disability (PTD) • Permanent & Partial Disability (PPD) • Major Disease (MD) • Critical Illness (CI) |

|||||||

| Group Insurance Products 1. Group Term Life (GT): |

|||||||

| a.Scope: The Scheme shall cover the risk of death while in service of an employee occurring anywhere in the world and by any reason for an amount (sum assured) as per list to be submitted by employer. b. Duration: The scheme for which premiums are payable yearly shall be for a period of 3 (three) years initially and thereafter may be extended for further period(s) on mutual agreement. c. Profit -Sharing Rebate: At the end of three years period if there arises a profit under the scheme i.e., if the resultant is positive after deducting management expense(s) and all claims from the total premium then a part of the resultant (depending on the number of employees) is allowed as rebate and credited against the renewal premium of the scheme. Profit sharing rebate is allowed for organizations having more than 400 insurable employees. |

|||||||

| 2. Group Term Life Insurance with Refund of Premium: | |||||||

| a. Scope: Provides for the stated sum assured at death by any reason of a member while in service. In case of survival of an insured employee to retirement age, 100% or 50% of all premiums paid on his account shall be refunded with or without profit as per choice of the employer. b. Duration: Initially the contract will be concluded for 10 years after which it may be continued for further period(s) on terms and conditions as may be mutually agreed. This scheme could be taken for a fixed term of 10, 15 or 20 years. c. Surrender Value: The policy accrues surrender value only after payment of at least two annual premiums. |

|||||||

| 3. Group Endowment Insurance: | |||||||

| a. Scope: Provides for payment of full sum assured at death by any reason of a member while in service. In case of survival of an insured employee to retirement age, 100%, 50% or 25% of respective sum assured shall be paid with or without profit as per choice of the employer. b. Surrender and Paid-up value: The scheme acquires paid- up and surrender values after at least two annual premiums have been paid. |

|||||||

| Who can take the scheme? | |||||||

| Any organization, institution, Professionals or NGO having at least 15 employees/members can take a group insurance scheme. | |||||||

| How the Employer Benefits? | |||||||

| Most employers provide group life/hospitalization insurance as a service benefit. By providing employees with a plan of group life/ hospitalization insurance coverage, an employer derives the following benefits: | |||||||

|

• Group Life Insurance protects Employers investment when an employee becomes ill. • It contributes to employee morale and productivity. • It helps to recruit and retain employees. • Creates a sense of gratitude towards the employer. • Employer can obtain a Tax deduction for the cost of contributing to the plan. • Employer's public and employee relations image is enhanced. • Creates an organization brand. |

|||||||

| How the Employee Benefits? | |||||||

| Individuals and families have a great need for life and health insurance plans. Unfortunately, many people are unable to purchase individual coverage because of preexisting medical conditions and/or the high cost of purchasing insurance. Therefore, many people rely on employer-sponsored plans as their sole source of life and health insurance. An employer- sponsored plan provides the following benefits for employees: | |||||||

|

• Opportunity to obtain basic coverage for all without evidence of insurability. • Virtually all members of a given group may be insured, regardless of their prior health history. • Assurance of financial security in case of catastrophic events like death or disability. • If the plan is contributory, the employee usually pays a lower rate per unit of benefits than is available with individual coverage. • If the plan is noncontributory, the employer pays for coverage that employees would otherwise have to pay for with personal money. |

|||||||

| How to take the scheme? | |||||||

• Simply, we need a formal letter from you asking quotation for group insurance scheme along with a list of employees/members to be insured giving following particulars:

• Prime Islami Life will then calculate the premium rate and submit the quotation. On receipt of premium Prime Islami Life issue 'Cover Note' taking the risk of life and subsequently arrange to sign a formal Group Insurance contract accordingly. |

|||||||

| How to Pay the Premium? | |||||||

| • Premium is payable in advance before commencement of risk preferably by an A/C payee cheque/PO/DD/EFT in favour of the Company or by cash at our Head Office. However, for payment of renewal premium one month's grace period is allowed. | |||||||

| Claim Procedure | |||||||

| Claim procedure is very simple under a group insurance scheme. Usually we need following documents at the time of processing a claim: | |||||||

|

• A formal request letter from the organization in respect of the (death/disability) claim. • A certificate from the organization to the effect that the insured member was in service till his death/disability. • An attested copy of age proof certificate issued by a competent authority (Usually S.S.C, in absence service record). • A death certificate issued by the last attending physician - usually from a registered doctor, Hospital or Clinic. • In case of accidental or unnatural death/disability, an attested copy of the First Intimation Report (FIR) along with an attested copy of the post-mortem report (if post-mortem has been done). If the post-mortem is waived then the documentary evidence of such waiver by a lawful authority must be submitted. |

|||||||

| All claims are settled by an account payee Bank Cheque in the name of the employer unless otherwise mentioned in the group insurance contract. | |||||||

প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেড ও ফরাজী হাসপাতালের চুক্তি।

প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেড ও ফরাজী হাসপাতালের চুক্তি।সম্প্রতি প্রাইম ইসলামী লাইফের সাথে ফরাজী হাসপাতালের মধ্যে এক কর্পোরেট চুক্তি অনুষ্ঠিত হয়।

প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের ৬১,৯২,২৫০/- টাকার মেয়াদোত্তর বীমাদাবীর চেক প্রদান।

প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের ৬১,৯২,২৫০/- টাকার মেয়াদোত্তর বীমাদাবীর চেক প্রদান।প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের বীমাগ্রাহক গোলাম কিবরিয়া জোয়ার্দার-এর মেয়াদোত্তর বীমাদাবীর ৬১,৯২,২৫০/- (একষট্টি লক্ষ বিরানব্বই হাজার দুইশত পঞ্চাশ) টাকার চেক হস্তান্তর অনুষ্ঠান..

প্রাইম ইসলামী লাইফ এবং ওকার লিমিটেডের গ্রæপবীমা চুক্তি।

প্রাইম ইসলামী লাইফ এবং ওকার লিমিটেডের গ্রæপবীমা চুক্তি। অদ্য ১ অক্টোবর, ২০১৯ তারিখে প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের সাথে ওকার (রাইড শেয়ারিং সার্ভিস) লিমিটেডের গ্রæপবীমা চুক্তি সংক্রান্ত এক সমঝোতা স্বাক্ষর প্রাইম ইসলামী লাইফের ..

কমোডর জোবায়ের আহমদ (ই), এনডিসি (অবঃ), বিএন প্রাইম ইসলামী লাইফের ভাইস চেয়ারম্যান নির্বাচিত

কমোডর জোবায়ের আহমদ (ই), এনডিসি (অবঃ), বিএন প্রাইম ইসলামী লাইফের ভাইস চেয়ারম্যান নির্বাচিতপ্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের ১৮৪তম বোর্ড সভা জুলাই ০৭, ২০২০ তারিখে কোম্পানির প্রধান কার্যালয়ে বোর্ড রুমে অনুষ্ঠিত হয়। উক্ত সভায় কমোডর জোবায়ের আহমদ (ই), এনডিসি (অবঃ), বিএন...

প্রাইম ইসলামী লাইফে কোরআন খতম ও দোয়া মাহফিল অনুষ্ঠিত।

প্রাইম ইসলামী লাইফে কোরআন খতম ও দোয়া মাহফিল অনুষ্ঠিত।আজ (সোমবার) কোম্পানির প্রধান কার্যালয়ে মাননীয় চিফ কনসালটেন্ট জনাব রহিম উদ-দৌল্লা চৌধুরীর শ্রদ্ধেয়া শাশুড়ী মিসেস রেজিয়া বেগম চৌধুরীর বিদেহী আত্মার মাগফিরাত কামনায়.

প্রাইম ইসলামী লাইফে কোরআন খতম ও দোয়া মাহফিল অনুষ্ঠিত।

প্রাইম ইসলামী লাইফে কোরআন খতম ও দোয়া মাহফিল অনুষ্ঠিত।আজ (বুধবার) কোম্পানির প্রধান কার্যালয়ে মাননীয় চেয়ারম্যান জনাব মোহাম্মদ আখতার-এর শ্রদ্ধেয়া মাতা মিসেস হামিদা খাতুনের বিদেহী আত্মার মাগফিরাত কামনায় কোরআন খতম, দোয়া মাহফিল ও

প্রাইম ইসলামী লাইফের চেয়ারম্যান’স ডিনার অনুষ্ঠান

প্রাইম ইসলামী লাইফের চেয়ারম্যান’স ডিনার অনুষ্ঠানসম্প্রতি প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের আয়োজনে চেয়ারম্যান’স ডিনার রেডিসন বøু ঢাকা ওয়াটার গার্ডেন, ঢাকায় অনুষ্ঠিত হয়। ডিনার পার্টিতে .

বীমা উন্নয়ন ও নিয়ন্ত্রক কর্তৃপক্ষের চেয়ারম্যান ড. এম মোশাররফ হোসেন, এফসিএ কে প্রাইম ইসলামী লাইফের ফুলেল শুভেচ্ছা

বীমা উন্নয়ন ও নিয়ন্ত্রক কর্তৃপক্ষের চেয়ারম্যান ড. এম মোশাররফ হোসেন, এফসিএ কে প্রাইম ইসলামী লাইফের ফুলেল শুভেচ্ছাবীমা উন্নয়ন ও নিয়ন্ত্রক কর্তৃপক্ষ (আইডিআরএ)-র নতুন চেয়ারম্যান ড. এম মোশাররফ হোসেন, এফসিএ এর সাথে শুভেচ্ছা সাক্ষাৎ করেছে প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের ব্যবস্থাপনা পরিচালক ও ..

প্রাইম ইসলামী লাইফের আনন্দ ভ্রমন-২০২০ অনুষ্ঠিত।

প্রাইম ইসলামী লাইফের আনন্দ ভ্রমন-২০২০ অনুষ্ঠিত।সম্প্রতি প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের আয়োজনে ড্রিম হলিডে পার্ক, নরসিংদীতে আনন্দ ভ্রমন ২০২০ অনুষ্ঠিত হয়। আনন্দ ভ্রমনে প্রধান অতিথি হিসেবে উপস্থিত ছিলেন কোম্পানির ভাইস চেয়ারম্যান কমোডর জোবা

প্রাইম ইসলামী লাইফের ১০% লভ্যাংশ অনুমোদন

প্রাইম ইসলামী লাইফের ১০% লভ্যাংশ অনুমোদনপ্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেড ২০১৯ সালের ৩১ ডিসেম্বর সমাপ্ত অর্থ বছরে শেয়ারহোল্ডারদের জন্য ১০ শতাংশ নগদ লভ্যাংশ অনুমোদন করেছে। অদ্য নভেম্বর ২৩, ২০২০ তারিখে ভার্চুয়াল প্লাটফর্মে

প্রাইম ইসলামী লাইফের কক্সবাজারে আনন্দ ভ্রমন-২০২০ অনুষ্ঠিত

প্রাইম ইসলামী লাইফের কক্সবাজারে আনন্দ ভ্রমন-২০২০ অনুষ্ঠিতসম্প্রতি প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের আয়োজনে হোটেল রয়েল টিউলিপ, কক্সবাজারে আনন্দ ভ্রমন ২০২০ অনুষ্ঠিত হয়। আনন্দ ভ্রমনে প্রধান অতিথি হিসেবে উপস্থিত ছিলেন কোম্পানির চেয়ারম্যান

প্রাইম ইসলামী লাইফের ২০২১ সালের ব্যবসা বর্ষ উদ্বোধন

প্রাইম ইসলামী লাইফের ২০২১ সালের ব্যবসা বর্ষ উদ্বোধনপ্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের ২০২১ সালের ব্যবসা বর্ষ উদ্বোধনী অনুষ্ঠান সম্প্রতি প্রধান কার্যালয়ের প্রশিক্ষন ও সেমিনার হলে অনুষ্ঠিত হয়।

এসইভিপি ও ইনচার্জ কাজী আবুল মনজুর সহকারী ব্যবস্থাপনা পরিচালক পদে পদোন্নতি

এসইভিপি ও ইনচার্জ কাজী আবুল মনজুর সহকারী ব্যবস্থাপনা পরিচালক পদে পদোন্নতিকোম্পানির মানব সম্পদ ও প্রশাসন বিভাগের এসইভিপি ও ইনচার্জ কাজী আবুল মনজুর সহকারী ব্যবস্থাপনা পরিচালক পদে পদোন্নতি পেয়েছেন।

প্রাইম ইসলামী লাইফের ডিনার পার্টি অনুষ্ঠিত

প্রাইম ইসলামী লাইফের ডিনার পার্টি অনুষ্ঠিতসম্প্রতি প্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের আয়োজনে প্যান প্যাসিফিক সোনারগাঁও ঢাকায় ডিনার পার্টি অনুষ্ঠিত হয়।

প্রাইম ইসলামী লাইফের বার্ষিক সম্মেলন ২০২০ অনুষ্ঠিত

প্রাইম ইসলামী লাইফের বার্ষিক সম্মেলন ২০২০ অনুষ্ঠিতপ্রাইম ইসলামী লাইফ ইন্স্যুরেন্স লিমিটেডের বার্ষিক সম্মেলন-২০২০ আমান উল্লাহ কনভেনশন সেন্টার, সিলেটে সম্প্রতি অনুষ্ঠিত হয়। সম্মেলনে প্রধান অতিথি